Crowdfunding Platforms Finance 21 Companies and the Financing Volume is Approaching Two Million Omani Rials

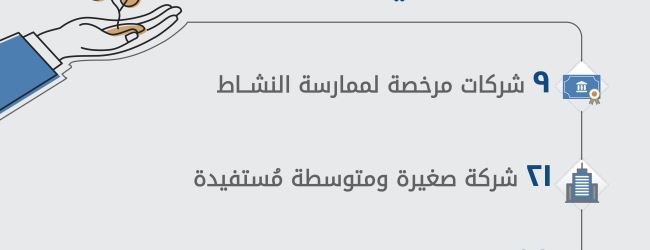

Based on the latest statistics of the CMA on the crowdfunding platforms, nine companies were licensed to carry out the activity of crowdfunding which are: Ethis Investment Platform LLC, Beehive Financial Technology, New Sphere LLC, Ithbar LLC, Alwadiaa for Commercial Operations LLC, Rawafid Finance, Smart Group for Finance LLC, Mamun Financial Technologies and Sharek Investment LLC. 21 companies received financing since their establishment; as the total financing volume is nearly 2 million Omani Rials only (RO 1,804,169) which was provided by Ethis Investment Platform and Beehive Financial Technology at the end of 2022.

Through launching crowdfunding platforms, the CMA aims to expanding the financing options in the market, facilitating access to financing and finding alternatives that cope with the technological revolution in the global capital markets. The crowdfunding platforms are considered as a breakthrough in the sector since they are dependent on one of the innovative financing types and they provide four financing options: donations, product, equity or investment note.

It is worth mentioning that during 2022, the CMA launched the mechanism for financing initiatives and projects through crowdfunding platforms which, in their turn, enabled project owners to present their projects through such platforms to get the required financing. This translates the CMA’s plan to enhance the role of the capital market as an instrument for financing projects in all their volumes and types. Additionally, such platforms will enable small and medium enterprises (SMEs) in particular and other projects in general to get their required financing from a wide base of national and foreign investors. Finally, crowdfunding platforms play a key role in driving the economic development and injecting liquidity in the market; in line with the Oman vision 2040.