Total Direct Insurance Premiums Increase by 11.9% and Net Compensations by 17% During the First Half of 2023

The insurance indices of the unaudited financial statements of first half of 2023 indicate that insurance premiums continues to grow by an increase of 11.9% compared to the same period last year. Gross written premiums reached RO 332.9 million where national companies took over the largest percentage 85.7% at about RO 285 million compared to RO 250 million in the previous year. As for foreign companies, the premiums reached RO 47.8 million. Takaful companies’ premiums accounted for 11% of the total insurance premiums of all companies at a total value of RO 37 million, an increase by 4.3% compared to the same period in 2022.

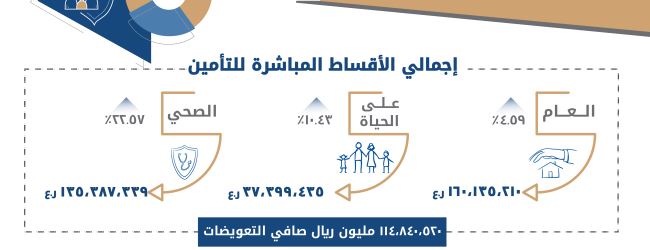

In addition, data indicates an increase by 17% at a value of RO 115 million in the volume of paid compensations by insurance companies for damages that the policyholders have incurred. Compared with first half of 2023, Takaful insurance figures decreased by 6% at more than RO 9.6 million of the total net compensations.

Moreover, written results of insurance companies illustrated that general insurance recorded the highest percentage of insurance premiums reaching more than RO 160 million in first half of 2023 compared to RO 153 million at the same period last year, which is an increase by 4.6% followed by health insurance that increased by 22.6% at RO 110 million. As for life insurance, the value of total direct premiums amounted to more than RO 37 million compared to RO 33 million in the previous year.

The data also showed an improvement in the net insurance premiums; which are the premiums retained after the deductions for reinsurance as such premiums rose by 14.1% at a value of RO 193 million in comparison to about RO 169 million in the previous year. This increase resulted from the increase of net premiums in most insurance types as life insurance (individual) recorded the highest increase amongst all insurance types by 69% at RO 7.7 million. Additionally, net premiums of property insurance amounted to RO 8.7 million, an increase by 37.3% compared to last year, and net premiums of health insurance rose by 18.4% at about RO 105 million.

Finally, operational results show that earned premiums value, net compensations and administrative and general expenses increased by 10.54%, 17.08% and 6.01%, consecutively.